23/01/22

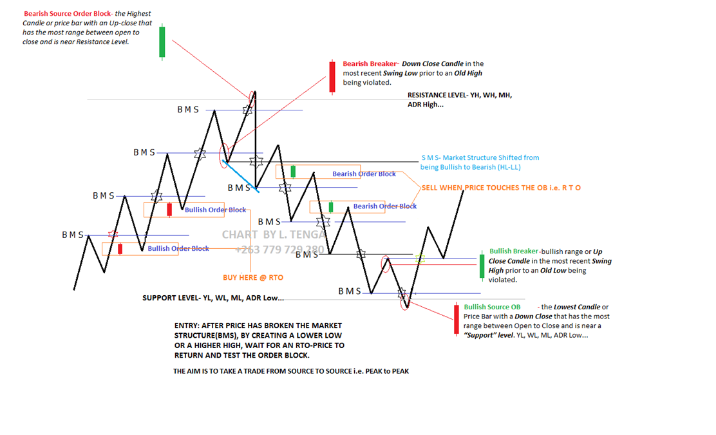

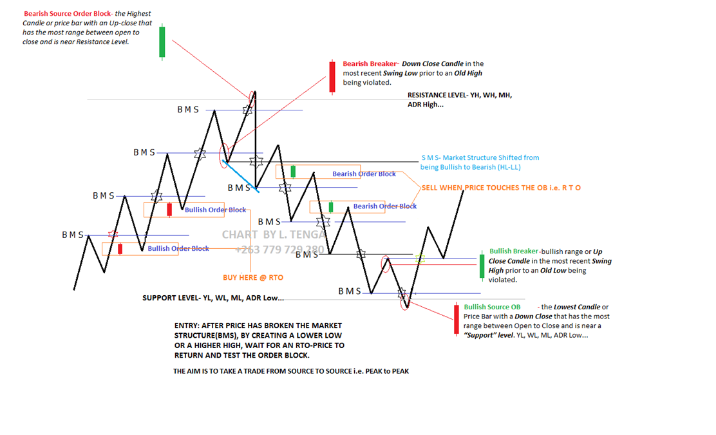

Institutions trade using order blocks.

The Order Block is a specific price range

or candle where institutions will be buying or selling againstb

theretail trend/dump money.

Institutions leave order blocks for themselves to trade at a later stage.

They will reverse the price to a previous order and

then driving the pricehard in the direction of the

trend(The real institutional trend).

These order blocks we can also call them specific levels of either going Long or Short.

If an order block is violated or broken, it now qualifies as a Breaker,

meaning Price will retest back to that

order block.

Sometimes we call it a failed order block.

NB:YOU DON’T TRADE ORDER BLOCKS STRAIGHTAWAY,

YOU WAIT FOR PRICE TO COME BACK

TO THAT ORDER BLOCK THEN YOU TAKE A TRADE.

23/01/22

Types of OBs:

i. Bullish Order Block (BUB)

ii. Bearish Order Block (BEB)

The Order of OBs

1. Source OB

2. Breaker OB

3. Continuation OB (Traditional/Basic OB)

Understanding Algorithmic Price Delivery

IPDA- Interbank Price Delivery Algorithm

OB-Order Block

FVG- Fair Value Gap

SMT- Smart Money

BiSi- Buy Side Imbalance Sell Side Inefficiency.

SiBi- Sell Side Imbalance Buy Side Inefficiency.

RjB- Rejection Block

RTO- Return to Order Block

RTF- Return to Fvg

BRK- Breaker

SOB- Source Order Block

BMS- Break of Market Structure

OTE- Optimum Trade Entry

23/01/22

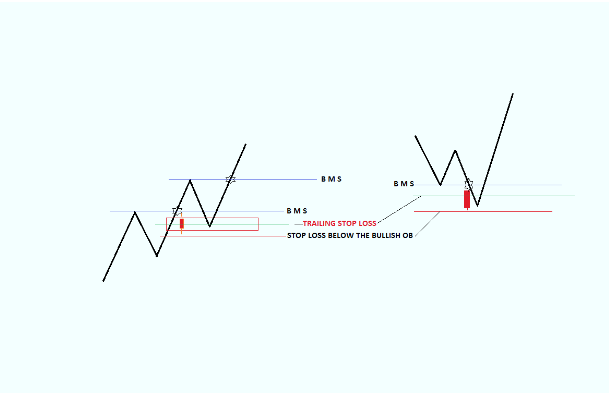

The Low of the Bullish OrderBlock

is the location of a relatively safe Stop Loss placement.

Just below the 50% of the OrderBlock

total range is also considered to be a good location

to raise the Stop Loss after Price runs away from

the Bullish OrderBlock to reduce Risk when applicable.